This transcript is available for the. Current year information may not be completely available until July. If a joint return, enter spouse’s name shown on tax return.

Automated transcript request. You are not required to provide the information requested. Record of Account, as it provides the most detailed information.

There is a fee to get a copy of your return. Name shown on tax return. In Person: (MUST make an appointment ahead of time) 1. There are five different kinds of tax transcripts you can request.

Social Security number , date of birth. Read the instructions on page 2. Line 5: provides non filers with the option to have their tax transcripts mailed directly to a 3rd party by the IRS. DO NOT have your tax transcripts mailed directly to the college. Enter only one tax form number per request. A tax return transcript does not reflect changes made to the account after the return is processed.

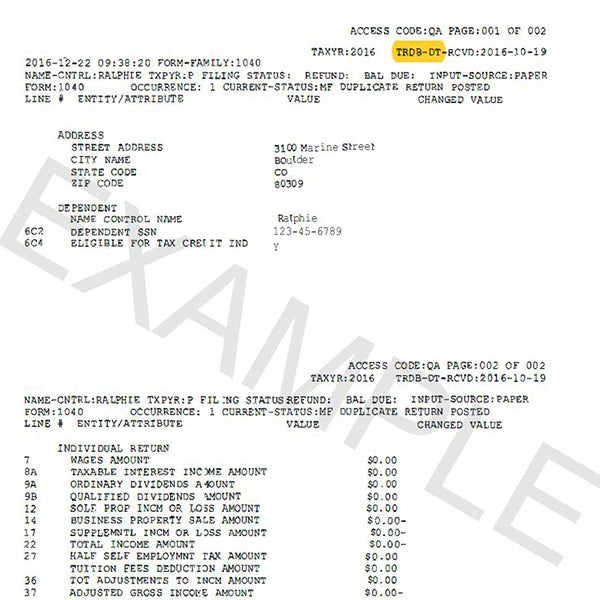

Return Transcript, which includes most of the line items of a tax return as filed with the IRS. Tax transcripts contain all the major information you need from a tax return. Tax Transcripts To The Rescue!

They would include adjusted gross income, filing, status, wages and other income, even a record of non-filing. The IRS keeps tax transcripts for each person for each of the last three years (plus the current year). Enter the tax year(s) for which you are requesting the transcript on line 9. Only one signature is required to request a transcript for a joint return. This line is only for transcripts and will walk you through the steps. You can request up to ten transcripts per call.

See the product list below. You need more details than those documents provide. Request for Transcript of Tax Return. When you request a tax transcript from our IRS Income Verification service and an income and employment verification from The Work Number, you get a more complete view of a borrower’s ability to pay. REQUESTING TRANSCRIPTS BY PHONE 1. Follow prompts to enter the primary tax filer’s social security number and address 3. In order to request tax transcripts , a person must have a social security number or tax ID number , and know the address they filed from previously.

If you were asked to submit a copy of your tax return documents and have chosen not to use the IRS Data Retrieval tool on the FAFSA or were unable to use this tool, please request transcripts from the IRS using one of the methods below. Online retrieval: Visit irs. Tax return transcripts can be requested online, through the U. Once the tax return transcript is receive submit a copy to the Financial. You will need to order a free tax return transcript if any of the following: You were selected for verification, used the IRS Data Retrieval Tool, and changed the imported data on the FAFSA. When receive submit the tax return transcript to KMBC.

However, we do sometimes ask for other IRS documents. Use the street numbers on your tax returns filed for that year.

Hiç yorum yok:

Yorum Gönder

Not: Yalnızca bu blogun üyesi yorum gönderebilir.