If you need your prior year Adjusted Gross Income (AGI) to e-file, choose the tax return transcript type when making your request. If you only need to find out how much you owe or verify payments you made within the last months, you can view your tax account. The method you used to file your tax return , e-file or paper.

This transcript is only available for the current tax year and returns processed during the prior three years. A tax return transcript usually meets the needs of lending institutions offering mortgages and student loans. GOVERNMENT SYSTEM IS FOR AUTHORIZED USE ONLY! Use of this system constitutes consent to monitoring, interception, recording, reading, copying or capturing by authorized personnel of all activities.

How to Get an IRS Transcript. You can also call the IRS to. Click on any year that is hyperlinked and a PDF will open in the same screen. Select Option to request an IRS Return Transcript and then enter the year of the return. The period in which you will receive the transcript varies from within ten to thirty business days from the time the IRS receives your request for the tax return or tax account transcript.

In addition to these methods, the IRS offers an online ordering tool to request tax return and account transcripts. Under the Tools section, click “Get your tax record” Click “Get Transcript online” to display your transcript immediately and print a copy. If you are a First Time User, click “Create Account”. Be sure to select Return Transcript and the appropriate year. Save the Transcript for submission to our office.

Upload the document when prompted when submitting Verification online from MyUNT. How do I get a copy of my tax return or transcript from the IRS ? The IRS charges $for each copy. Tax filers can request a transcript, free of charge, of their tax return from the IRS in one of three ways.

In the TOOLS section of the cli k “Get a Tax Transcript by Mail”. There are different kinds of transcripts one may request from the IRS : Tax Return Transcript. This is the most common type of IRS tax transcript. Amendments made after filing the tax return , however, do not show in this document. If you need a statement of your tax account which shows changes that you or the IRS made after the original return was file however, you must request a tax account transcript.

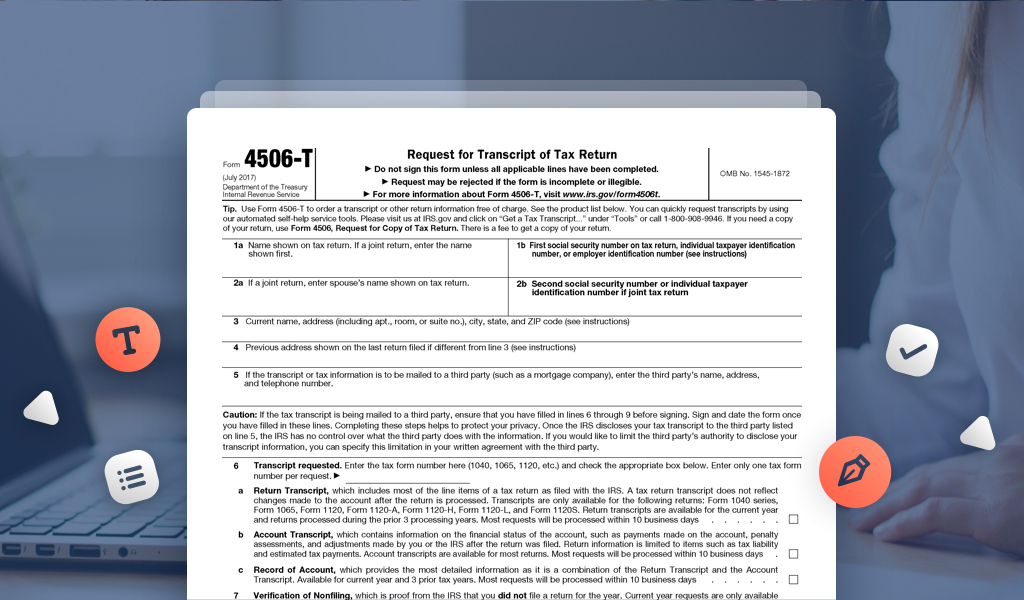

IRS Data Retrieval Tool for FAFSA. If you need a copy of your filed and processed tax return , it will cost $for each tax year. Mail it to the IRS address listed on the. Request for Transcript of Tax Return. Refer to Transcript Types and Ways to Order Them for more information.

Check the box for Form W- specify which tax year(s) you nee and mail or fax the completed form. If you do not (or cannot) use the DRT, you can request a free IRS Tax Transcript using one of the options below. A return transcript shows most lines from the original tax return as it was processed. Changes made to the return after it was processed are not reflecte including any amended returns you may have filed. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms.

However, we do sometimes ask for other IRS documents. Is this possible to go back that far? Many students are selected for a process called verification by the Department of Education and are required to submit income information and other documents before they are eligible to receive a financial aid award.

Hiç yorum yok:

Yorum Gönder

Not: Yalnızca bu blogun üyesi yorum gönderebilir.